Fast, accurate, and effortless payroll.

Paying your team through Workmax is easy and efficient – run your payroll in just a few clicks.

Benefits of Workmax Payroll

Advanced and fast

Pay your employees with a few clicks.

Automated payments

Pay your employees directly from Workmax.

Accurate

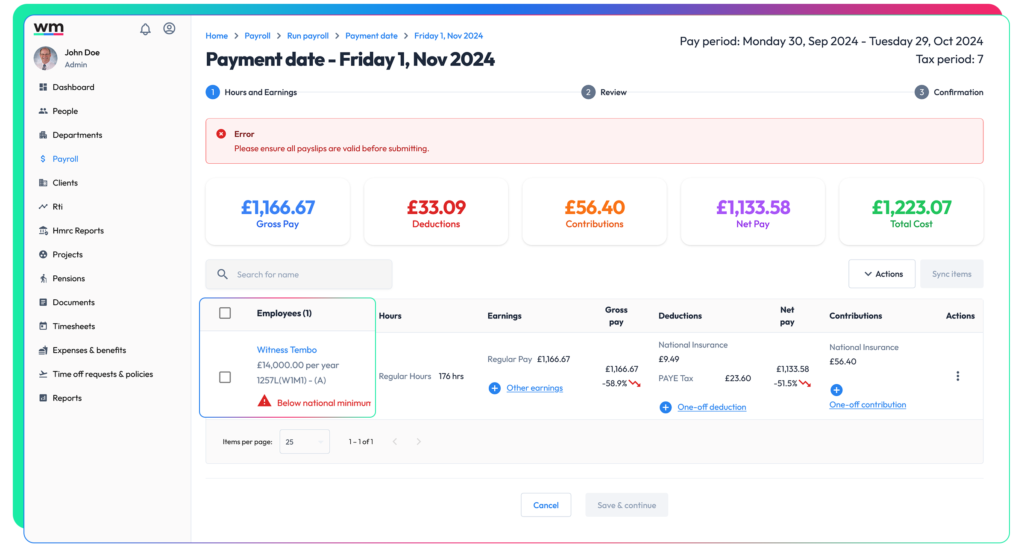

Error-free payroll with payroll validation.

Compliance

Timely tax and pension submissions.

How it works

Run your payroll in minutes.

Forget payroll headaches! A few clicks, and your team is paid. Fast, flexible, and fee-free.

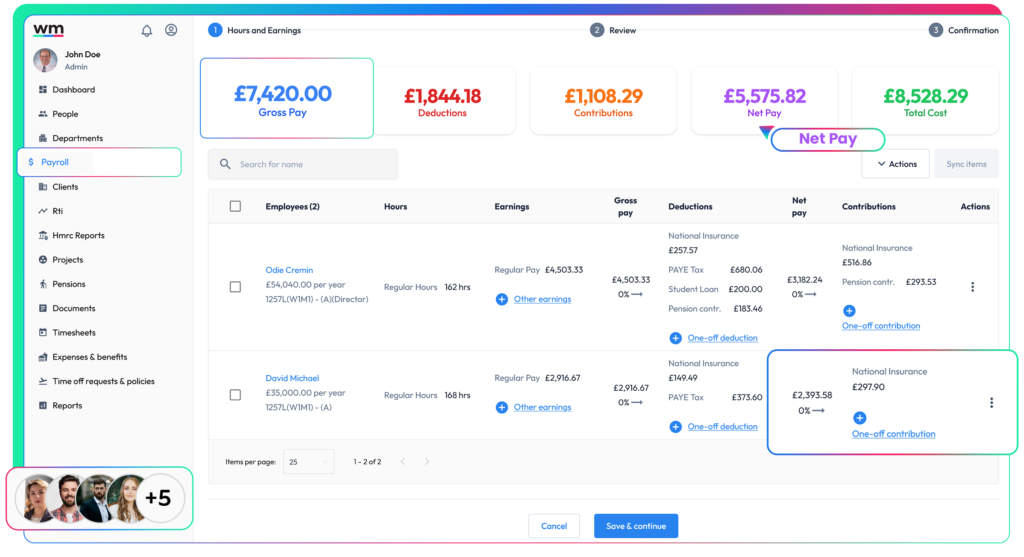

Sync your team hours automatically

Review your payroll for accuracy and compliance

Submit! Your teams' pay is on the way

Payroll features

Automatic Calculations

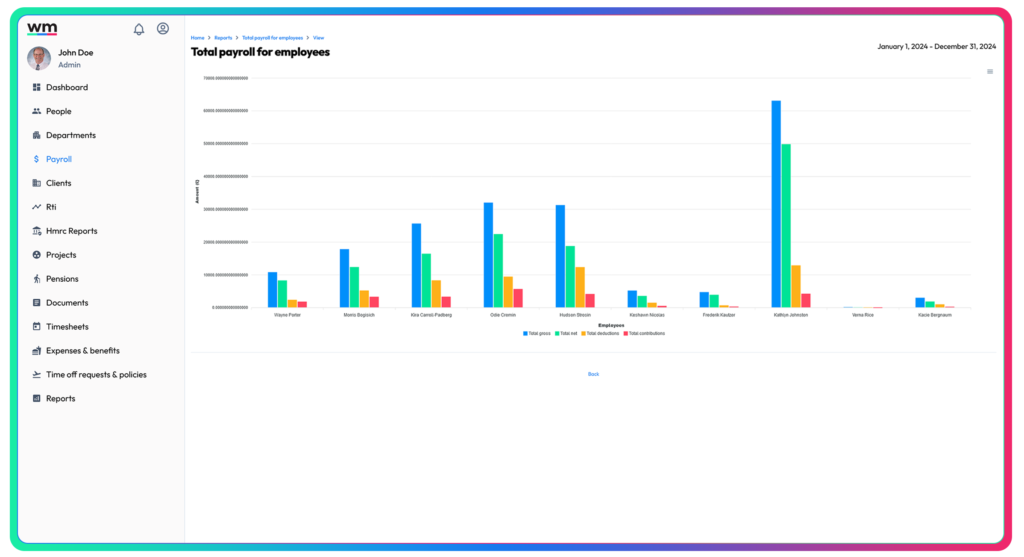

Variance Reporting

Instant Faster Payments

Sync Timesheets

Compliance

Payoll benefits

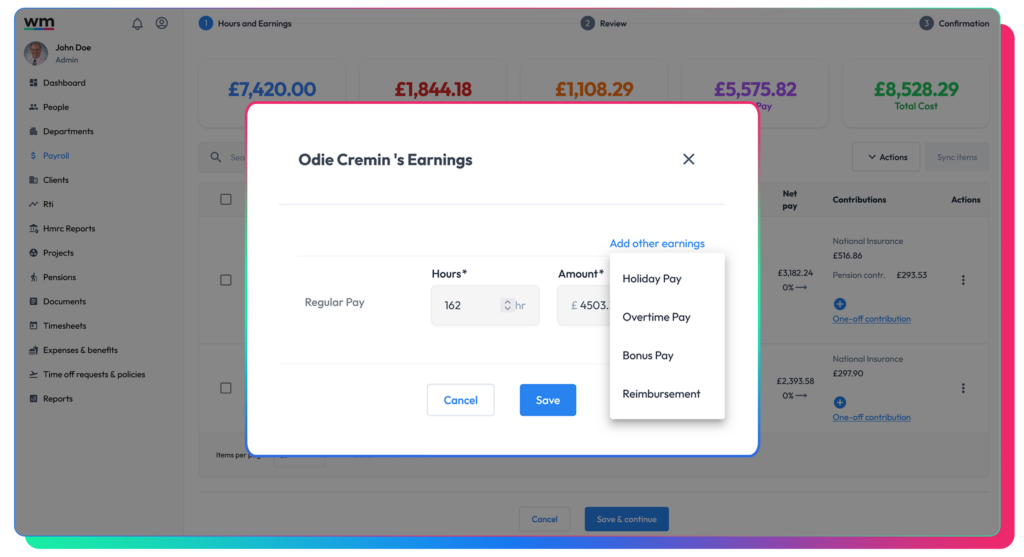

Multiple earning types

HMRC RTI Submissions

Intelligent payroll

Automated calculations

Accurate Calculations, Less Effort: Streamline your tax and NI calculations with automation.

Variance reporting

Accurate Payroll, Every Time: Compare earnings for error-free payments.

HMRC RTI submissions

Streamline RTI: Submit FPS & EPS documents with ease.

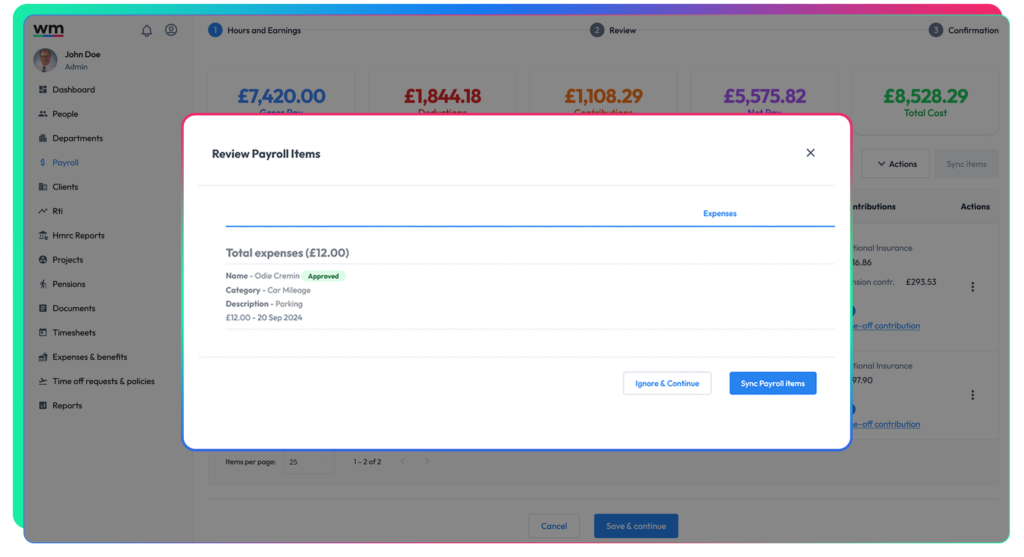

Sync pay items

Timesheets

Automated Payroll: Sync timesheets and calculate wages seamlessly.

Time off requests

Gain Insights: Track holiday pay and optimise your pay distribution.

Expenses

Effortless Expense Claims: Reimburse your team with minimal hassle.

Compliance

Minimum wage

Peace of Mind: Ensure compliance with NMW & NLW regulations.

Automatic tax updates

Stay Compliant: Let Workmax keep you up-to-date on tax law changes.

Holiday leave entitlements

Save Time, Reduce Errors: Automate holiday leave entitlements for all employees.

Payroll analytics

Download payroll reports

Verify & Analyse: Ensure accuracy with detailed payroll reports.

Export payroll journals

Seamless Integration: Export payroll journals effortlessly.

Unlock business insights

Outperform Competitors: Uncover insights and optimise your business.

Multiple Earning Types

Enhanced Parental Leave

Don’t Let Life Events Impact Your Employees: Ensure fair compensation.

Termination Payments

Protect Your Business: Handle terminations accurately and legally.

Holiday Payments

Don’t Shortchange Your Employees: Accurately track holiday earnings and hours.

Frequently Asked Questions

How long does it take run payroll end-to-end via Workmax

Running payroll with Workmax is effortless. Our automated tools can complete payroll in under 5 minutes.

Which tax filings are automatically filed?

Workmax will send FPS on the scheduled payment date for each pay frequency.

How will payroll funds be sent to employees

Workmax offers two methods to transfer funds to employees Automated and Manual. With the our automated process employees will received funds within minutes of running payroll. The manual process involves downloading a payment file to submit to your banking portal.

Where's my data housed? How secure is Workmax

Workmax customer data is hosted in the United Kingdom We use a Zero Trust model to keep your data locked down at every level, and we take multiple measures to ensure it stays that way. Here are just some of the measures we take to prevent data leaks and unauthorised data access: